Graphite at the Center of Securing Critical Minerals Supply Chain

Countries such as the U.S. and Australia are zeroing in on graphite as part of their strategies to counter China's battery dominance.

In This Briefing

Graphite has recently been in the spotlight following the U.S.’s proposed tariff on Chinese graphite, along with other developments related to this critical mineral found in batteries. For context, the U.S. is 100% import-reliant on graphite, 43% of which comes from China, according to the USGS. As the U.S. moves to counter China’s dominance in the battery sector, it has gained a significant deal with Indonesia, reflecting the many moving parts in the U.S.’s broader strategy to secure the critical minerals supply chain.

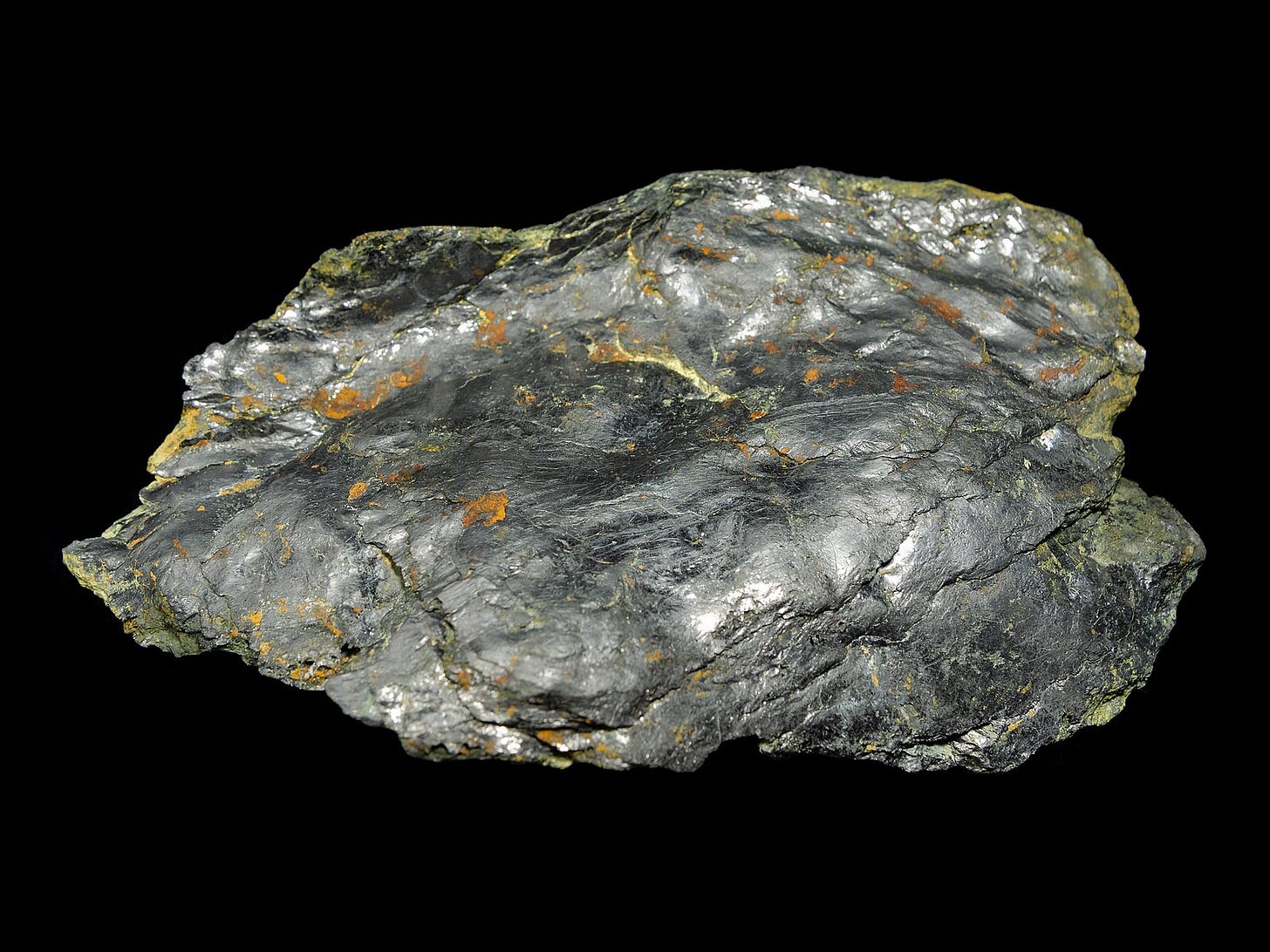

🔎Mineral Spotlight: Graphite

The U.S. Commerce Department has put forth a 93.5% anti‑dumping tariff on Chinese anode-grade graphite, accusing exporters of selling below cost in the U.S. market. Domestic graphite producers praise the move as crucial for building local supply chains, but automakers and domestic battery makers could face sharp price hikes. The tariff is expected to raise EV prices as it could increase the price of a battery by $1,000. According to the New York Times, “The decision is preliminary, but companies must begin paying the duties immediately.” The final ruling on the decision is slated for this December.

New York Times: U.S. Proposes Steep Tariffs on Critical E.V. Battery Material

💡For Deeper Insights: Unplugging Beijing - FDD

Other developments related to graphite:

Graphite One has entered a Memorandum of Understanding with Lucid—and other U.S. battery-material developers—under the newly formed MINAC (Minerals for National Automotive Competitiveness) collaborative. The move aims to build a fully domestic supply chain for both synthetic and natural graphite used in EV battery anodes, reducing reliance on foreign sources and aligning with recent White House directives on critical minerals.

The Australian mining company Syrah Resources Ltd. has resumed operations after a 7-month hiatus caused by protests. The US International Development Finance Corp., together with the Department of Energy, has helped Syrah Resources to “build stronger supply chains,” according to Bloomberg. The company stated that it will have two shipments of battery material, one of which will go to an “unnamed” customer in the U.S.

Bloomberg: Mozambique graphite shipments restart after election violence

Atlas Critical Minerals, a 30.1%-owned subsidiary of Atlas Lithium, announced exceptional surface sampling results from its Brazilian projects, including rare earth oxide grades up to 28,870 ppm TREO, 23.2% titanium dioxide, and 96.6% graphite concentrate. The company controls over 575,000 acres of mineral rights across Brazil, which hosts the world’s second-largest graphite reserves. These results bolster Atlas’s strategic position in global supply chains for critical minerals essential to defense and tech industries.

Atlas Lithium Corporation Press Release: Atlas Lithium's Critical Minerals Subsidiary Reports Strong Rare Earths, Titanium, and Graphite Results

Australia has moved on bolstering its domestic critical mineral production of graphite with the latest approval given by Queensland to Australian mining company Graphinex. The Queensland government has granted Graphinex’s graphite project in Esmerelda “Coordinated Project” status, fast-tracking the project’s development. According to Australian Mining, Queensland Natural Resources and Mines Minister Dale Last stated, “With a reported 25 million tonnes of graphite in this region – the third-largest deposit in the world – (Esmeralda) will help build Queensland’s critical minerals capability and strengthen domestic supply chains.”

Australian Mining: Major graphite project backed by Queensland

🚨 Tariffs Imposed, Trade Deals Secured

At the same time the White House has implemented tariffs on Chinese graphite, it has also secured a trade deal with Indonesia. Indonesia produces one of the largest amounts of nickel in the world, making it a key player in the EV battery industry. Some highlights to come out of this week’s deal:

“Indonesia will eliminate tariff barriers, on a preferential basis, on over 99% of U.S. products exported to Indonesia across all sectors…”

“The United States and Indonesia are committed to strengthening cooperation to increase supply chain resilience. This includes addressing duty evasion and cooperating on export controls and investment security. Indonesia will remove restrictions on exports to the United States for all industrial commodities, including critical minerals.”

“…Indonesia will pay the United States a reciprocal tariff rate of 19%,” a new tariff rate from the previously reported 32% proposed by the U.S, according to The Hill.

The White House: The United States and Indonesia Reach Historic Trade Deal

🌍 Around the World

KoBold Metals, a U.S.-based mining company backed by Bill Gates and Jeff Bezos, signed a preliminary mineral exploration agreement with the Democratic Republic of Congo (DRC). The deal aims to strengthen U.S. access to critical minerals such as cobalt, copper, and lithium, ultimately targeting China’s influence on the supply chain. KoBold seeks to employ AI-powered exploration tools to identify mineral deposits and digitize Congo’s geological data, starting with a lithium project in Manono.

📌Mining.com: KoBold signs Congo deal to boost US mineral supply

Zambia has taken delivery of 31 fully electric mining trucks from the Chinese firm Breton Technology, marking Africa’s largest single deployment of green mining vehicles. The trucks, equipped with smart automation and fleet management systems, will be used in a major copper mining project operated by China’s 15th Metallurgical Construction Group. This move supports Zambia’s push to modernize its mining industry, reduce emissions, and deepen economic ties with Beijing, which has pledged $5 billion in mining investments by 2031.

📌Business Insider Africa: Zambia receives 31 electric-powered trucks from China for major copper mining project

Spanish energy firm Zelestra, backed by Sweden’s EQT, will invest up to $1.5 billion over five years to build 1 GW of renewable energy in southern Peru, targeting the country’s copper-rich mining sector. The initiative includes solar, hybrid, and battery-powered plants like the newly inaugurated San Martin solar park (300 MW) and upcoming Babilonia project (238 MW). With long-term contracts and growing demand for clean energy, Zelestra aims to help decarbonize Peru’s mining industry while expanding its footprint across Latin America.

📌Reuters: Spain's Zelestra aims to power Peru mines with $1 billion renewables investment

China’s Ministry of State Security is intensifying efforts to combat the illicit export of rare‑earth minerals, citing national security concerns. The crackdown follows a June agreement with the U.S. to ease rare-earth export restrictions, aimed at ensuring American industries retain access to these critical inputs used in batteries, electronics, and defense technologies. Chinese investigators found that smugglers engaged in transshipping, using routes through Thailand and Mexico to move materials to the U.S.

📌Associated Press: China pledges to crack down on illicit exports of rare earths, urges US to lift more trade controls

🔒 Premium Content

As mentioned in our first installment, our premium content will showcase insights gained from OSINT research. For now, subscribers will have a preview of the content offered.

Zambia’s first critical minerals guide recently went live and shares findings from studies conducted on operating mines in the country. Some interesting points:

Although Zambia’s cobalt production has declined sharply from 5600 tonnes (about 6172 tons) in 2012 to 252 tonnes (about 277 tons) in 2022, it is set to host Africa’s first cobalt sulfate refinery by the end of 2025. This effort will be led by Kobaloni Energy with a $100 million investment.

Zambia’s nickel production has tripled from 2500 tonnes (about 2756 tons) in 2019 to 7980 tonnes (about 8796 tons) in 2023.

As Seen on Facebook: Zambia’s first critical minerals guide supports the country’s potential in global clean energy transition

Vulcan Energy has received €104 million (~$120 million USD) in grants from Germany’s federal and state governments to fund its Li4BAT initiative, part of the company’s Lionheart Project. The funding will support two key facilities: a Geothermal Lithium Extraction Plant in Landau and a Lithium Hydroxide Processing Plant in Frankfurt. The grants aim to strengthen Europe’s battery supply chain with sustainable, locally sourced lithium, and will be disbursed over 36 months starting October 2025, contingent on financing and construction milestones.

Vulcan Energy: €104m (~A$186m) grants approved by German governments

Critical Minerals Watch is a Valens Global intelligence product focused on developments in critical minerals, global supply chains, and international security. This edition is part of our public archive. Premium subscribers receive early access, exclusive briefings, and in-depth geopolitical analysis. To learn more about Valens Global, visit our website.